Tax Brackets 2025 Au. These tax rates apply to individuals who are australian residents for tax purposes. Increased the threshold above which the 45 per cent tax rate applies from $180,000 to $190,000.

Learn about the new tax rates, their impact on different income brackets, and how to best prepare for these significant financial shifts. Discover the australia tax tables for 2025, including tax rates and income thresholds.

2025 Tax Brackets Taxed Right, This tool is designed for simplicity and ease of use, focusing solely on income tax calculations.

How to Calculate Tax in Australia One Click Life, Reduce the 32.5 per cent tax rate to 30 per cent;

2025 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth, The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in australia.

2025 Tax Brackets The Only Changes You Need to Know About theSkimm, During the year, employers use these brackets to ensure you are taxed accordingly each pay period.

2025 IRS Limits The Numbers You Have Been Waiting For, Also calculates your low income tax offset, help, sapto, and medicare levy.

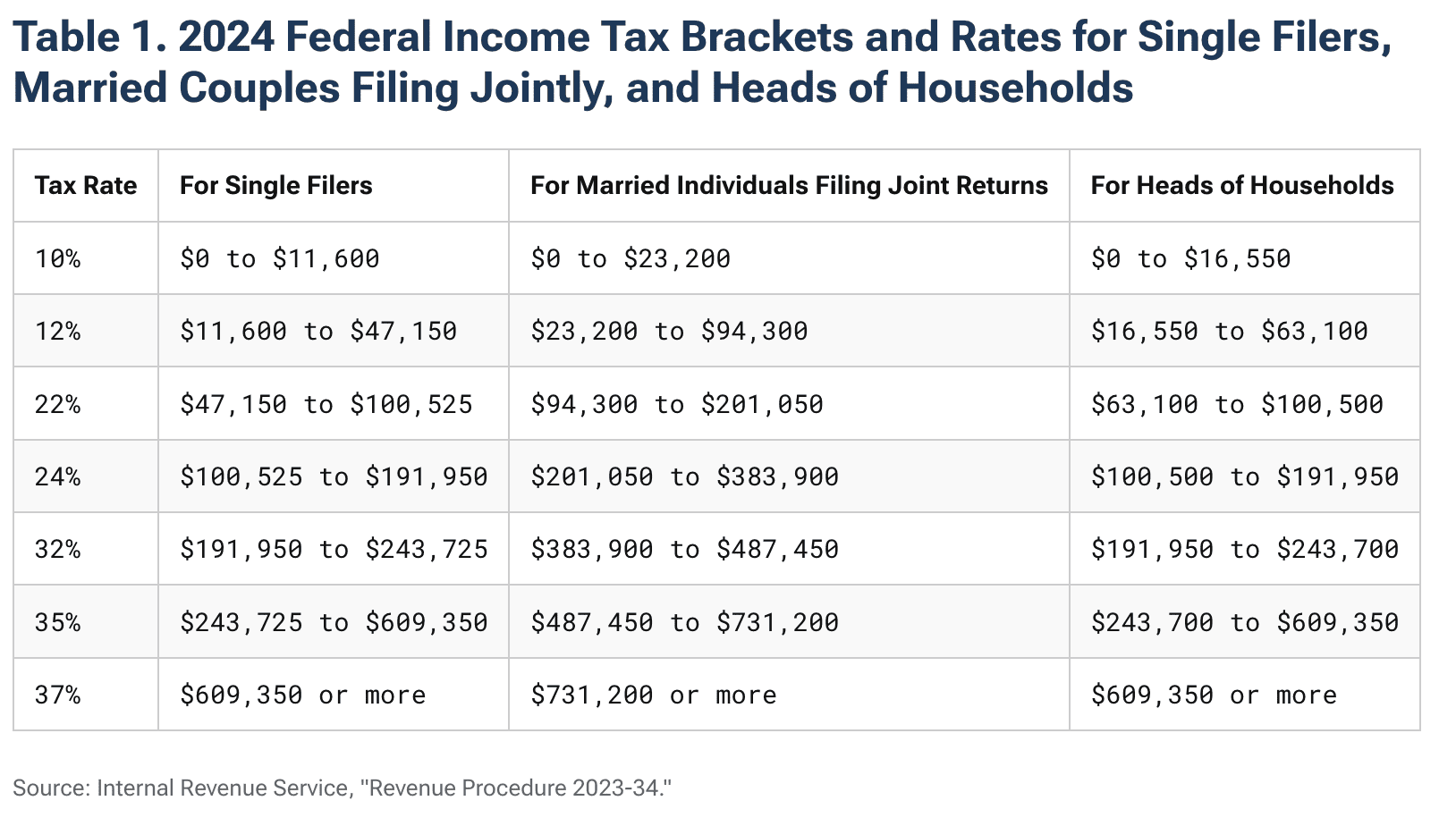

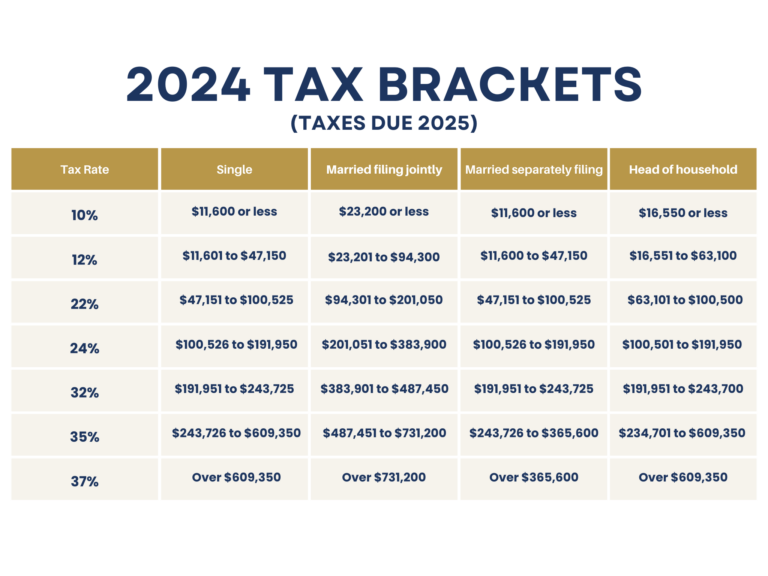

The 2025 Tax Brackets By Modern Husbands Free Nude Porn Photos, The proposed tax cuts reduce the 19% tax rate to 16%, reduce the 32.5% tax rate to 30%, increase the threshold for the 37% tax rate from $120,000 to $135,000, and increase the threshold for the 45% tax rate from $180,000 to $190,000.

Understanding 2025 Tax Brackets What You Need To Know, This tool is designed for simplicity and ease of use, focusing solely on income tax calculations.

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Taxable income between $45,001 and $120,000:

2025 Tax Brackets Here's Why Your Paycheck May Be Bigger This Year, There are different income tax brackets for australian residents, foreign residents and working holiday makers.

Tax Rates Archives Conner Ash, All associated earnings taxed at individual’s marginal tax rate.