Income Limit For Ssdi 2025. The ssa sets an income limit for substantial gainful activity and changes it every year in order to keep up with the cost of living. At a tax rate of 6.2%.

In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default. In 2025, the limit for most people is.

The social security administration deducts $1 from your social security check for every $3 you earn in the months before your birthday above.

That is what the social security administration (ssa) set as the income level above which is considered a worker “not.

Social security Disability Benefits Pay chart 2025, 2025, 2025 for, In 2025, the sga limit for blind recipients is $2,460 per month, while the sga. In 2025, you cannot earn more than $1,470 per month (or $2,460 if you are blind) and still qualify for ssdi.

Disability benefits These are the limits for people with, The 2025 income limit for those receiving ssdi benefits was $1,310 per month. / updated march 29, 2025.

Federal Disability Retirement vs Social Security Disability Insurance, The ssa sets an income limit for substantial gainful activity and changes it every year in order to keep up with the cost of living. The maximum taxable income increase will translate into $391 more in taxes in 2025 that workers will have to pay into the social security.

What is the Difference between SSI and Social Security Disability, Disability recipients must adhere to the social security administration’s substantial gainful activity (sga) limit for additional earned income. There’s a limit on how much you can earn and still receive your full social security retirement benefits while working.

How Much In Social Security Disability Benefits Can You Get? SSDI, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default. The table below shows medicaid’s monthly income limits by state for seniors.

Social Security Disability and How to Apply YouTube, In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default. Disability recipients must adhere to the social security administration’s substantial gainful activity (sga) limit for additional earned income.

What’s the Difference Between SSI & SSDI?, Social security and supplemental security income (ssi) benefits for more than 71 million americans will increase 3.2 percent in 2025. There’s a limit on how much you can earn and still receive your full social security retirement benefits while working.

2025 Ssdi Earnings Limit Sharl Natalina, In 2025, if you collect benefits before full retirement age and continue to work, the social security administration will temporarily withhold $1 in benefits for every. At a tax rate of 6.2%.

/ Earnings Limits in 2025 for SSDI, Social Security Disability, The social security administration deducts $1 from your social security check for every $3 you earn in the months before your birthday above. In 2025, you cannot earn more than $1,470 per month (or $2,460 if you are blind) and still qualify for ssdi.

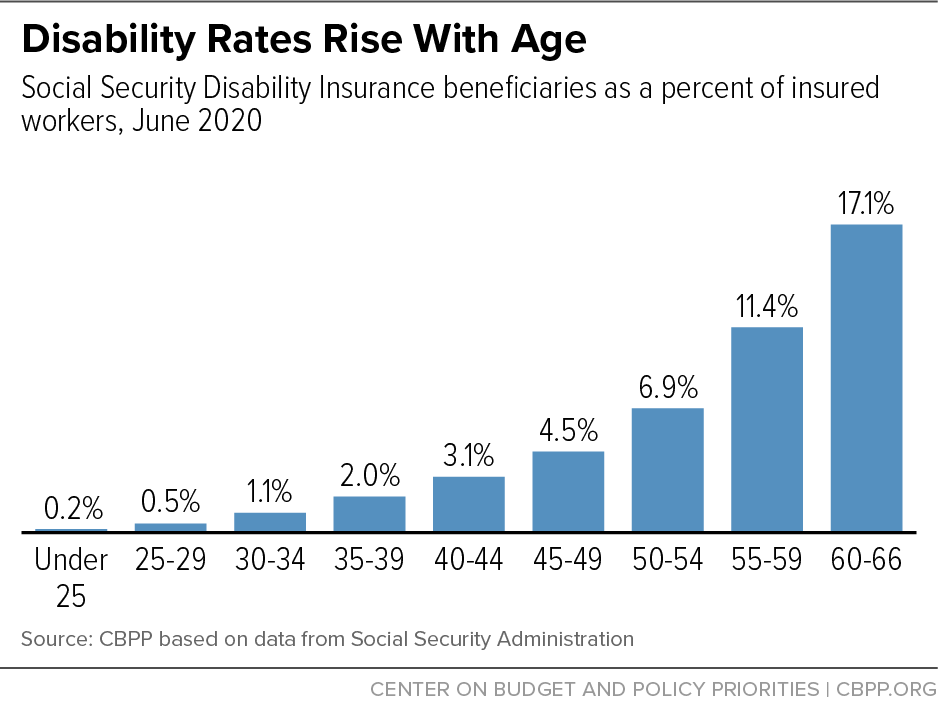

Chart Book Social Security Disability Insurance Center on Budget and, In 2025, the sga limit for blind recipients is $2,460 per month, while the sga. A change in how the social security administration (ssa) determines supplemental security income (ssi) benefits could boost monthly.

A change in how the social security administration (ssa) determines supplemental security income (ssi) benefits could boost monthly.

The maximum taxable income increase will translate into $391 more in taxes in 2025 that workers will have to pay into the social security.