Hsa Limits 2025 Married Person. — getting married can result in 5 changes to your hsa: — the health savings account (hsa) contribution limits increased from 2025 to 2025.

For 2025, you can contribute up to $4,150 if you have individual coverage, up. Dependent care fsa limits 2025 married person.

Maximum Annual Hsa Contribution 2025 Married Filing Eba Kristy, — annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

2025 HSA Contribution Limits Claremont Insurance Services, Dependent care fsa contributions are limited to $5,000 a year for individuals or married.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple.

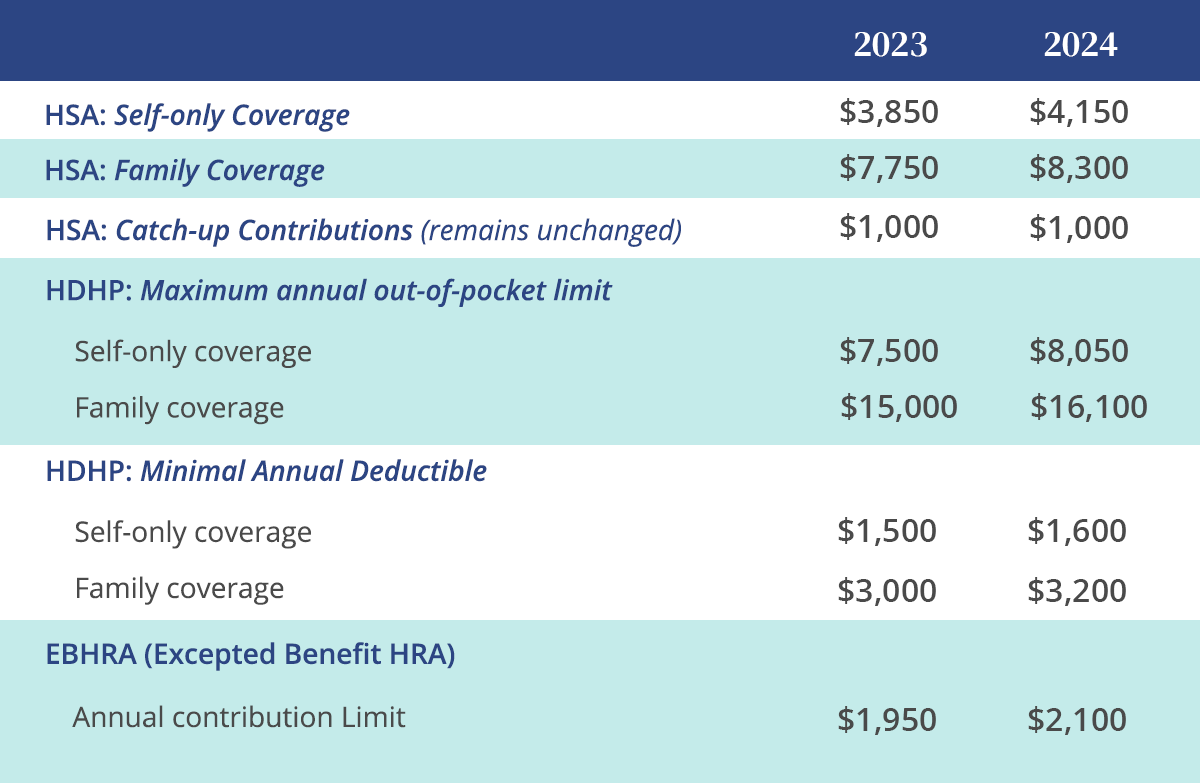

Significant HSA Contribution Limit Increase for 2025, — hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families.

Hsa Contribution Limits 2025 For Married Couples Over 55 Alla Lucita, — getting married can result in 5 changes to your hsa:

Hsa Limits 2025 Married Shea Cristal, — the hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Hsa 2025 Contribution Limits Chart Dasha Estella, — the health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years.

HSA Contribution Limits for 2025 and 2025 YouTube, — this compliance overview summarizes key features for hsas, including the contribution limits for 2025.

Maximum Annual Hsa Contribution 2025 Married Filing Eba Kristy, Employer contributions count toward the annual hsa.